Our ALM model provides expert insight into the risk and reward trade off by considering assets in tandem with liabilities.

What does an ALM project entail?

In order to optimise the investment strategy to meet the objectives within a risk tolerance limit, an ALM exercise would first involve a risk budgeting exercise where the expected liability cashflows, risk profile and stakeholders’ risk appetite are taken into consideration.

Assets are then typically selected to match the liabilities in terms of nature, term and currency – this is to ensure the guaranteed liability outgo can be met and when applicable, asset mismatching risk managed where changes in discount rate impacts value of the liabilities. The next step is to introduce increasing exposure to riskier growth-oriented asset classes – how much and the mix of assets are influenced by the risk tolerance limits. An economic scenario generator is utilised to model the asset and liability movement stochastically and capture the required reward and risk metrics.

It is hence important to clearly articulate the investment objectives and risk tolerance levels. An optimal strategy balances the expected target return on the invested assets (reward) vs the acceptable level of investment risk that can be absorbed (risk).

The SAA is a long-term asset allocation designed to meet long term objectives. There can be opportunities to temporarily diverge from SAA to either profit from market conditions or manage a liability profile. Thus, an SAA should also include a dynamic asset allocation plan to be complete. For social security and pension funds, this benefits not only the fund sponsor but allows the management more flexibility to enhance benefits.

To attain good governance practice, an investment policy would then be formalised which requires monitoring and regular review.

Figure 1: Key Areas in the Investment Policy

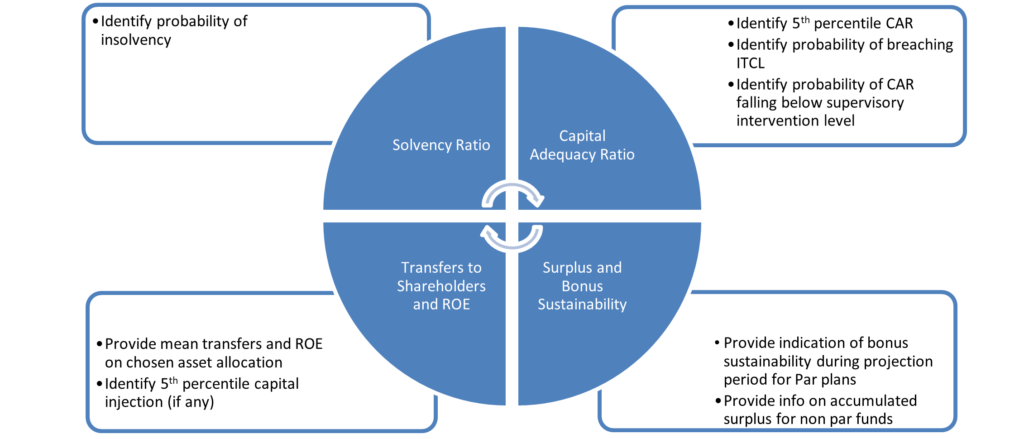

Figure 2: Typical Risk & Reward Measures for Life Insurers

What is a scenario analysis?

Scenario analysis has long been at the heart of modelling for life insurers with both deterministic and stochastic scenarios used.

Actuarial Partners is certified as a member of Moody’s Analytics Partner Alliance Insurance Solution partnership program[1]. We work with Moody’s Analytics to utilise their stochastic generator engine[2] to model investment scenarios of market risk and asset returns that takes into account multi timestep projections – often for the very long term, typical of insurers’ liabilities. With these, we would calibrate the generator to reflect our client’s asset portfolio. The scenarios form a basis of the advice APC provide in risk budgeting and optimal strategic asset allocation work.

In December 2022, BNM issued a policy document which requires financial institutions to employ scenario analysis to determine the resilience of their business strategies to material climate-related risks[3]. For climate risk – the effect can be thought of in two different ways – not just physical risk such as catastrophic floods or forest fire, but also the implications of government policy changes and what it means to the economy in the long term. Hence, the complication for modelling climate change scenarios is that it needs to be also need to be linked to a policy narrative, for example Business As Usual – which assumes temperatures rise at the current predicted rate – or Net Zero being achieved in a target year, for example 2050. We rely on subject matter experts such as Moody’s Analytics who have dedicated resource to tackle and model these challenges. Their solution[4] provides different climate pathways of different policy narratives.

[1] https://www.moodysanalytics.com/about-us/partner-alliance/insurance-solution-partners

[2] https://www.moodysanalytics.com/product-list/real-world-scenario-generator

[3] Climate Risk Management and Scenario Analysis – Policy Document (bnm.gov.my)

[4] https://www.moodysanalytics.com/articles/2023/climate-scenario-analysis-for-the-life-insurance-sector

Subject Matter Experts

Case Study: Asset Liability Study for SOCSO’s Employment Insurance System

Our goal with this project was the derivation of an optimal Strategic Asset Allocation (SAA) and Investment Policy. For this project we modelled the ALM with liability considerations, SAA strategy, set out the Statement of Investment Policy (“SIPO”) and determined tactical allocations.

Case Study: Advisor on Participating Business Estate Management for a large multinational Insurer with USD1+billion in estate

Our goal with this project was the derivation and management of the participating fund estate. We assessed suitability of the liability driven investment strategy to meet future bonuses and determined the “working capital” of the estate required to support volatility in experience, including that of investment.

Case Study: Asset Liability study of a large local life insurer in Malaysia

Our goal with this project was the derivation of an optimal SAA and included the modelling of ALM with the Risk Based Capital CAR computation, design of the SAA strategy and determination of tactical allocations.

Learn more about ALM in our CLAP 4 online course.

For more information please visit our learn@AP site.